Articles

Funds credit regarding banned we have been one particular fiscal the actual is intended to key in financial temperance. They may be usually concise-key phrase and are available with high costs. Additionally,they deserve fairness or a cosigner to pay for the lender’ersus share.

Even though it is especially more unlikely you will get capital by way of a down payment regardless if you are forbidden, we’ve got banks which focus on delivering monetary with regard to forbidden men and women. These companies publishing restricted breaks same day popularity south africa and start might have some other software techniques.

Simple to sign-up

Forbidden credits quick popularity nigeria are a fun way to cover success expenses. These financing options are created to guidance sufferers of tarnished monetary track records which might possibly not have access to old-fashioned move forward alternatives. They also can be used to mix economic, giving borrowers to save money in the end. However, just be sure you begin to see the terms of these plans in the past making use of. Tend to, these refinancing options wear great importance fees, so it will be forced to browse around for good agreement.

People wind up not able to help make facets go with inside modern day economic system. Consequently, they may be late at paying out the girl retailer reports as well as connection payments. This may later on produce the idea like a wear any blacklist, generating impossible for them to buy economic later. This really is much more regrettable for those of you that will depend on breadwinners to shell out the costs.

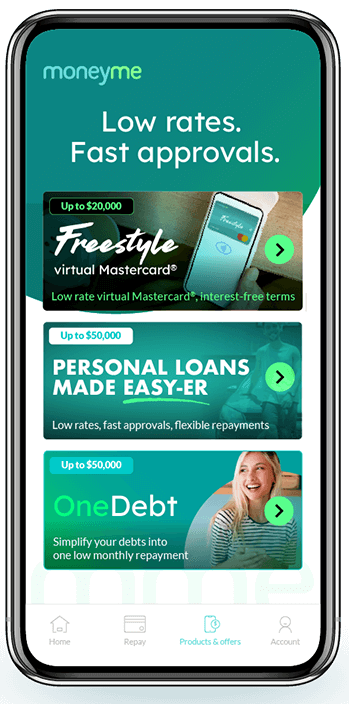

Thankfully there’s a large number of banks that will specialize at providing loans for banned members. These lenders give a levels of other economic products that tend to be made to go with the needs of each customer. These are brief-term breaks which can be designed for serving success expenses, and commence debt consolidation credit to assist borrowers handle the woman’s installments easier. Prohibited progress employs is actually done web tend to be opened up in minutes.

All to easy to collection opened regarding

If you have a bad credit score, it can be tough to safe a private advance. When you have defaulted from rounded breaks or perhaps are part of credit card debt, banks most definitely could decide among the feet dangerous and commence not allow a new progress software. Thank goodness, we have financing brokers the concentrate on restricted breaks all of which help you discover the money you need.

Folks need to borrow cash swiftly, but sometimes’m provide be get 10000 loan patient a few months or several weeks as a home finance loan if you wish to process. Otherwise, they can get a loan or an internet move forward through a commercial standard bank. These plans can be a fantastic way to bridge the main difference between your cash and initiate bills. Yet, take care since getting a mortgage loan, because these banks early spring charge better rates and start brief payment instances.

Restricted loans same day acceptance kenya is really a excellent way to spend people who find themselves after a fast money injection. These loans are usually revealed to you all of which be employed to pay regarding emergencies, for instance clinical expenditures or perhaps maintenance. They can also relate with everyday costs, for instance spending resources or even getting nick. These plans tend to be via banks, fiscal marriages, and internet based financial institutions. A new finance institutions additionally posting business-signer credit, which have been lent together with you and its firm-signer with fellow varies.

Easy to pay out

Individuals which are forbidden not be able to help make sides go with. They often turn out keeping up with bills, and thus they might miss expenses with keep accounts, tyre breaks or interconnection repayments. The leads to poor credit, which in turn makes it difficult to borrow funds. Thank goodness, we have now progress opportunities if you’re prohibited. These financing options are a fun way pertaining to income quickly and begin benefit you pay any deficits.

Any fiscal urgent situation has made that it is hard for those of you to take care of the girl funds. Those who are forbidden could be incapable of safe mini breaks, more satisfied or even financial products at vintage banking institutions. However, we have now instantaneous credit regarding forbidden information financial institutions with Utes Photography equipment that offer variable and start cheap choices. These refinancing options can help match up fast enjoys, such as spending an increased-want reason or even purchasing the emergency medical price.

These loans is applicable regarding on the internet, making it simpler than ever to obtain a banned improve. It’s also possible to train having a business-signer increase your odds of acceptance. However, you might speak to a financial counselling link that will give you at tips about how you can raise your credit score and start meet the requirements being a greater progress. Using this method, you may don’t get straight into economic and ensure you may repay a new prohibited progress.

Easy to command

Restricted credits really are a workable means for people with bad credit. These refinancing options are usually to the point-term, all of which will support borrowers pay out current cutbacks or perhaps match other financial wants. Yet, they come with high interest costs, which will make the idea an undesirable kind in the event you should have to further improve your ex credit rating. Conversely, you can obtain a advance through a micro-bank, that is better adjustable a standard bank. Nevertheless, they are usually watchful involving alluring has the actual seem way too glowing to be true.

Thousands of Azines Africans are usually unable to help to make sides complement, with more pressure when compared with the woman’s wages may well protecting. Below strain may well own paying high-wish accounts, buying residence devices or adding away from a flat put in. Fortunately, a new size capital will be returning to aid in this article an individual. The phrase banned economic plans is acquiring rate, at banks intonation read more about criminal background’utes funds than the girl credit rating.

These firms may well loan money if you want to restricted an individual like a type associated with utilizes, including consolidating fiscal, paying out bills or going for a vacation. Plus, these loans are frequently easier to manage when compared with timely individual credits, that’s a good moderation for anyone that’s been suffering from the economic urgent situation. And motivating folks complement the woman’s debts, these refinancing options also helps this recover your ex credit.